Need help understanding mortgage requirements in today’s challenging market? Mortgage rates now hover around 5% — compared to just 3% a couple of years ago — making your application’s success more critical than ever.

Qualifying for a mortgage requires at least 5% of the property’s value as a deposit (that’s £12,500 on a £250,000 home). Lenders typically allow borrowing up to four-and-a-half times your annual household salary. Your credit score plays a vital role too, as lenders check it first to assess their confidence in your repayment ability.

House prices stalled last year because high mortgage rates prevented many people from moving. Proper preparation remains significant. First-time buyers now opt for “marathon” mortgages that last 35 years or longer. Lenders have set maximum age limits for repayment — usually by 70, 75, or 80. Getting your documents ready and improving your finances before applying could determine whether you get approved or disappointed.

Image Source: Alexander Southwell Mortgage Brokers

Payday loans can wreck your mortgage application, even when you’re doing well financially. These short-term, high-cost loans might look harmless at first glance, but mortgage lenders see them in a completely different light.

What are payday loans

Payday loans are short-term, high-interest loans you need to repay by your next payday. Lenders usually offer smaller amounts between £100 and £1,000 to help cover emergency expenses when cash runs low. Regular loans work differently from payday loans, which can charge sky-high interest rates—a typical two-week payday loan with a £15 per £100 fee equals nearly 400% APR.

Your credit file shows these loans for six years. A single payday loan from the past might affect your mortgage application.

Why they harm your mortgage chances

Mortgage lenders see payday loans as warning signs that indicate potential money problems. Here’s what makes them problematic:

- Shows poor money management: Lenders think payday loans mean you struggle with budgeting

- Points to money troubles: They believe you need short-term debt to pay monthly bills

- Raises affordability concerns: Lenders worry you might not handle mortgage payments well

- Limits your options: Many major lenders just say no to applications with payday loans

Lender policies about payday loans rarely give straight answers. These loans stand apart from other credit issues, as lenders often say things like “refer to underwriter” and “case-by-case basis”. This makes getting a mortgage much harder for people with payday loans in their history.

How to avoid them

Smart alternatives to payday loans include:

- Build an emergency fund for surprise expenses

- Look into personal loans that charge less interest—these cost less than payday loans, even with bad credit

- Get free debt advice from non-profit groups if money’s tight

- Start budgeting to handle big expenses better

Your chances of getting a mortgage improve if you stay away from payday loans for at least 12 months before applying. The gap between your last payday loan and mortgage application should be as long as possible.

A specialist mortgage broker can help if you’ve used payday loans before. They know which lenders might say yes and can present your finances in the best way possible.

Image Source: Money Saving Expert

Credit cards can actually boost your mortgage application if you use them right. Smart credit card habits show lenders you’re financially responsible – exactly what they want to see in potential borrowers.

What is strategic credit card use

Smart credit card use means treating your cards as spending tools, not borrowing tools. You use your cards for everyday purchases and pay off the full balance each month. This way, you’re not building up debt. Your card becomes a payment method that gives you extra perks like expense tracking, fraud protection, and rewards while building your credit profile.

Studies show 64% of adults in the UK own at least one credit card, with average balances of £1,675. Smart users keep their balances low and pay them off quickly, unlike those who carry debt month after month.

Why it helps your bank statements

Mortgage lenders look through your bank statements to see how well you manage money. Here’s how smart credit card use helps your application:

- Improves debt-to-income ratio – Lenders think you’ll pay 3-5% of your credit card debt monthly. Lower balances mean lower payments, making you look more affordable.

- Demonstrates consistent payment patterns – Your payment history makes up about 35% of your credit score. Regular payments on time show you’re reliable.

- Shows spending discipline – Clean statements without overdrafts or wild spending prove good money habits.

You need a credit score of 740 or higher to get the best mortgage rates. Using credit cards strategically helps you hit and keep this score.

How to manage your cards

Here are some proven strategies to prep for your mortgage application:

Pay your balances before statements close. Card companies report balances to credit bureaus at statement closing, whatever you pay by the due date. This timing helps keep your credit utilisation low – ideally under 30%.

Don’t apply for new credit cards while you’re getting ready for a mortgage. New credit checks can drop your score and make lenders nervous.

Set up automatic payments for at least the minimum due to avoid missed payments. It’s better to pay everything off each month.

Keep your card balances as low as possible for at least six months before you apply. Lenders check both individual and total credit usage across all your cards.

Image Source: Create Finance

Direct debits are a must-have when you’re getting ready for a mortgage application. This simple money management habit will boost your chances of getting approved by a lot. Lenders love to see that you’re reliable and organised with your finances.

What are direct debits

Direct debits let companies automatically collect money from your bank account on specific dates. They’re different from standing orders because the company controls the payment amount, not you. This payment method works great for regular bills like utilities, council tax, insurance, and subscriptions.

Your payments happen automatically each month – no need to do anything manually. UK Finance reports that direct debits factored in more than 75% of household bill payments in 2022. The amounts can stay the same (like council tax) or change based on what you use (like electricity bills).

Note that the Direct Debit Guarantee protects you if something goes wrong. Your bank must give you a refund if they or the company collecting payment makes a mistake with your direct debit.

Why they show financial responsibility

Mortgage lenders look closely at how you handle your money. Direct debits are a vital part of what they check:

- Demonstrate reliability – Regular direct debit payments show you’re good at keeping up with your financial commitments, which lenders really value

- Prevent missed payments – Missing payments stays on your credit file for six years and can hurt your chances of getting a mortgage

- Show organisational skills – Setting up automatic payments proves you’re on top of your finances

- Create clean bank statements – Your statements look better when they show regular, on-time payments through direct debits

Direct debits help you pay bills on time, which is exactly what mortgage lenders want to see. In fact, using direct debits for all your regular payments helps you avoid accidentally missing any payments that could damage your credit score.

How to set them up

You can set up direct debits easily:

- Contact the service provider – Most companies let you set up direct debits online, by phone, or in writing

-

Provide necessary details – You’ll need:

- Your name and address

- Your bank account number and sort code

- Your account’s name(s)

- Choose payment dates – Pick dates that work best with when you get paid

- Monitor your account – Keep an eye on your bank statements to make sure everything’s working right

Most regular bank accounts work with direct debits, and some special savings accounts offer this too. You’ll get written confirmation within three working days for phone or online setups, or at least 10 working days before your first payment.

Start using direct debits for all your household bills at least six months before you apply for a mortgage. This shows lenders you’re serious about managing your money well.

Image Source: Money Saving Expert

Your mortgage application success depends on your debt levels, whatever your income might be. Mortgage lenders take a close look at what you owe to determine your borrowing capacity.

What counts as existing borrowing

Your application review includes several types of debt. These typically include:

- Credit card balances

- Personal and student loans

- Car finance agreements

- Store cards

- Buy now, pay later arrangements

- Existing mortgages or rent payments

- Child support obligations

Your credit file shows debts from the past 7-10 years, including both outstanding and closed accounts. Lenders get into how much of your available credit you use, and amounts above 50% of your limit raise red flags.

Why it affects affordability

Your existing debt affects your debt-to-income (DTI) ratio—a vital calculation lenders use to determine affordability. This ratio shows what percentage of your monthly income goes to debt repayments.

To cite an instance, see a monthly income of £2,000 with £500 in debt repayments – this creates a DTI ratio of 25%. Lenders usually prefer DTI ratios below 30-35% to offer their best mortgage deals. Some might accept DTI ratios up to 50%, though terms won’t be as attractive.

Lenders assume you’re paying 3-5% of your credit card balance monthly, whatever you actually pay. This assumption can substantially change how they see your affordability.

How to reduce your commitments

Here are some budget-friendly debt-reduction strategies to help with your mortgage application:

- Prioritise high-interest debts first – these cost more and worry lenders most

- Pay down credit card balances to under 20% of your credit limit to show responsible credit management

- Avoid opening new credit lines six months before applying – this could increase your DTI ratio

- Think about timing – be careful with debt consolidation before remortgaging since new credit temporarily affects your credit score

- Focus on consistent repayments with variable income to show stable financial management

A lower debt-to-income ratio makes you a lower-risk borrower, which helps you qualify for better mortgage rates and higher amounts. Note that lower debt levels improve your credit score and give you more financial flexibility with your mortgage application.

Image Source: Money Saving Guru

Mortgage lenders pay close attention to how you use your bank account’s overdraft facility. Your overdraft habits send clear signals about how you manage money and can substantially affect your chances of getting a mortgage approved.

What is an overdraft

Your current account comes with a borrowing option called an overdraft that lets you spend more than what you have in your account. You’ll find two main types:

- Arranged (authorised) overdrafts – pre-approved borrowing limits agreed with your bank that usually have lower fees and interest rates

- Unarranged (unauthorised) overdrafts – spending more than your balance or going over your arranged limit without approval, which leads to higher charges

Most banks now offer overdraft facilities with their accounts. These work as a short-term backup when unexpected costs pop up or you face temporary cash flow problems. Your bank looks at your financial situation and sets limits anywhere from £100 to thousands of pounds.

Why overdrafts are red flags

Bank statements get a close look from lenders who spot several warning signs in overdraft usage:

Your regular use of overdrafts hints at money troubles or poor financial planning. Lenders see frequent overdrafts as a sign you might find it hard to handle a mortgage payment on top of your other expenses.

Mortgage providers question your spending habits if you keep dipping into your overdraft, especially unauthorised ones. FHA loans require extra steps – lenders must manually approve borrowers who have NSF fees, even after computer approval.

Banks worry about your reliability when they see bounced payments or returned direct debits. They look for warning signs like overdrafts, insufficient funds charges, and sudden big purchases while checking your financial health.

How to manage your account

These account management tips can boost your mortgage chances:

- Stay within your arranged limit – The six months before applying should show no unauthorised overdrafts

- Reduce or cancel unused overdrafts – Large unused overdrafts might look like potential debt to lenders

- Avoid increasing your overdraft limit – Recent limit increases suggest money problems

- Demonstrate consistent account management – Build a record of keeping your account in credit

- Re-schedule direct debits near your payday to help with cash flow

Your account should show a steady positive balance for three to six months before you apply for a mortgage. This shows lenders you know how to handle money well and makes approval more likely.

Image Source: Etsy

More families help with mortgage deposits these days. Lenders need proper documentation to accept these funds when you apply for a mortgage.

What is a gift letter

A gift letter documents that money given toward your mortgage deposit is a gift and not a loan. This document proves that you don’t need to repay the funds. We used this letter to show that gift givers claim no financial interest in the property and expect nothing in return for their contribution.

The letter should include:

- Names and addresses of both the donor and recipient

- Your relationship with the gift giver

- The exact amount being gifted

- Confirmation that you don’t need to repay the gift

- Declaration that the donor won’t claim property ownership

- A statement about the donor’s financial stability

Why lenders require it

Lenders ask for gift letters for several significant reasons. They need to check that the funds aren’t a hidden loan that could affect your debt-to-income ratio. The person giving money can’t be involved in the property sale—this includes sellers, builders, real estate agents, or anyone with financial stakes in the deal.

Gift letters also help meet anti-money laundering rules. Lenders must verify all funds used to buy property are legitimate. This documentation helps them assess your true financial position without hidden debts affecting what you can afford.

How to prepare one

Your lender might have their own template to work with. The letter should go to the lender through your mortgage broker. All donors must sign it, and couples can use a joint letter.

You’ll also need supporting documents that show where the money came from:

- Bank statements showing the donor’s withdrawal

- Deposit slips or statements showing money in your account

- The gift giver’s photo ID (passport or driving licence)

- The donor’s address proof through utility bills or official documents

Note that lenders usually accept gifts from immediate family members. Friends, employers, or distant relatives’ contributions might need extra checks or face rejection.

Image Source: Money Saving Expert

Mortgage lenders read your bank statements carefully. They tell a revealing story about your financial habits. The core team gets into three to six months of your banking history to assess if you’re a reliable borrower, which makes it significant to handle your accounts strategically.

What this means

You need to run your account as if you already have a mortgage. This involves disciplined money habits that show you can handle regular mortgage payments. Your account should stay in the black consistently. Erratic spending patterns must be avoided while maintaining stability in your daily finances.

Loan officers look through your bank statements to verify your income. They assess your spending habits and check your recurring expenses. The evidence they seek shows you can afford the deposit, closing costs, and ongoing mortgage payments.

Why it impresses lenders

Risk assessment tops the priority list for mortgage providers. Bank statements that reflect mortgage-ready behaviour make you a lower-risk applicant.

The core team checks for:

- Income deposits that match your stated salary consistently

- Spending habits showing you live within your means

- Regular patterns of saving money

- Stable financial management

Clean bank statements without overdrafts or erratic spending paint a compelling picture of your financial responsibility. You demonstrate that you’re not living on the edge of your finances—something lenders think over carefully.

How to simulate mortgage behaviour

Your accounts need proper preparation for mortgage review:

Your balance should stay positive for at least three months before you apply. Overdrafts should be avoided completely since they hint at possible financial strain.

Non-essential spending and subscriptions should be cut back to create leaner statements. The full picture from lenders might raise questions about impulsive or lavish purchases.

Direct debits for bills and savings should automate your finances. This shows strong organisation and ensures all payments happen on time.

Betting transactions should be completely avoided as they raise red flags with lenders. Even occasional gambling can suggest risk-taking behaviour that worries mortgage providers.

A smoothly running account with consistent patterns should be maintained for 3-6 months before applying. This approach will give a strong foundation for your mortgage application.

Image Source: NatWest

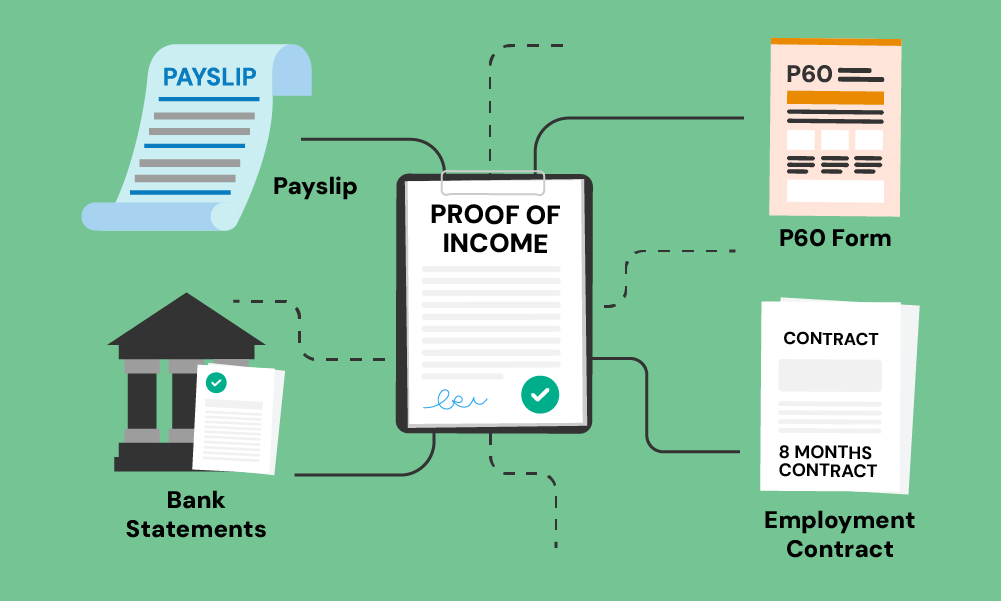

Your paperwork preparation can make the difference between a smooth mortgage approval and frustrating delays. Lenders need detailed documentation to verify your identity, finances, and eligibility before they approve your application.

What documents do I need when applying for a mortgage

Mortgage lenders usually ask for several types of documents:

Identity verification

- Passport or driving licence

- Utility bills, council tax statements or bank statements dated within the last three months

Income evidence

- Latest three months’ payslips (four weeks’ worth if paid weekly)

- P60 form from your employer

-

Self-employed applicants need additional documentation:

- Latest two years of tax calculations and tax year overviews

- Business accounts or accountant’s certificate

Financial stability proof

- Three to six months of bank statements

- Statements for all investment accounts (if applicable)

- Proof of deposit source

- Gift letter if family members are contributing

Additional documentation

- Proof of any benefits received

- Property details for the home you’re buying

- Information about existing debts

Why being organised helps

We found that having documents ready helps speed up your application processing time. Most lenders hold your interest rate for only 14 days while you gather supporting documentation. Good preparation reduces your risk of losing your preferred rate.

Incomplete applications often face delays or rejection. Well-organised paperwork helps underwriters verify your financial situation quickly without asking for more information. This keeps your application moving forward smoothly.

How to compile your file

You should start collecting documents at least three months before applying. Many lenders accept electronic submissions, so create digital copies of everything.

Make sure all addresses on your documentation match your application details to avoid delays. Double-check that names appear the same way across all documents.

Many lenders want online statements in their original format instead of screenshots. Both applicants must provide their documentation separately for joint applications.

A mortgage broker can help guide you through specific documentation requirements for different lenders. This might increase your chances of approval.

Image Source: Money Saving Guru

Self-employed people face unique challenges with mortgage applications because lenders need solid proof of stable income. Regular employees can show their payslips, but self-employed applicants must provide extensive documentation to prove their earning power.

What is verifiable income

Verifiable income for self-employed applicants means documented earnings that mortgage lenders can confirm through official records. This includes:

- SA302 forms – Tax calculations showing your income breakdown based on Self Assessment submissions

- Tax year overviews from HMRC confirming your tax payments

- Certified accounts – Financial statements prepared by qualified accountants

- Bank statements showing regular business income

- Contracts for upcoming work (for contractors and freelancers)

Lenders usually want two to three years of accounts to see a reliable income pattern. Your verifiable income typically has your salary plus dividends if you own a limited company.

Why it matters for self-employed applicants

Law requires lenders to verify borrowers’ ability to pay their mortgage. Self-employed income tends to go up and down more than regular salaries, which makes lenders careful about your payment ability.

Lenders calculate most self-employed applicants’ affordability based on net profit instead of turnover. Your mortgage potential directly links to your declared taxable income.

Self-employed applicants face different assessment methods based on their business structure:

- Sole traders: Average net profit over 2-3 years

- Limited company directors: Salary plus dividends, sometimes including retained profits

- Contractors: Daily or hourly rates multiplied by working patterns

How to prepare your accounts

Here are some strategies to maximise your verifiable income:

You should hire a qualified accountant to prepare your financial information. Lenders often need accounts certified by professionals, especially if your business structure is complex.

Balance your tax efficiency with mortgage needs carefully. A lower taxable income cuts your tax bill but also reduces the income figure lenders use to calculate your borrowing power.

Keep detailed records of all income sources with mortgage requirements in mind. Gather evidence of future contracts and steady work from reliable clients to strengthen your application if you’ve been self-employed for less than two years.

Image Source: Mortgage Advice Bureau

Your bank statements showing betting transactions can ruin your chances of getting a mortgage. Many lenders see gambling as a warning sign, no matter how occasional it might be.

What spending habits raise red flags

Lenders carefully watch several spending patterns that could indicate risk:

- Gambling transactions – Small betting amounts worry lenders too. Some reject applications based on how often you gamble rather than the amounts

- Large unexplained cash deposits – These make lenders ask questions about where the money comes from and possible illegal activities

- Frequent or expensive holidays – These suggest you might lack financial discipline

- Unbudgeted social spending – High entertainment costs point to poor money management

- Regular large transactions to undisclosed accounts

We focused on checking if these habits could affect your ability to pay your mortgage reliably for years.

Why lenders scrutinise statements

Lenders get into 3-6 months of bank statements before they decide. This detailed review became more intense after the Mortgage Market Review regulations. These rules made lenders more responsible to ensure borrowers can truly afford their mortgages.

Lenders perform “stress testing” as they review your statements. They check if you could still manage mortgage payments with higher interest rates. Betting habits worry them because this behaviour suggests financial instability and high risk.

Brokers tell us that automated systems now flag gambling transactions, whatever the amount. Some advisory companies built systems that spot transactions with bookmakers specifically.

How to clean up your finances

Your bank statements need to look good for mortgage approval:

- Stop all gambling transactions at least 3-6 months before you apply

- Keep your spending patterns steady

- Make a budget and follow it

- Document all large transactions you need to make

- Find a mortgage broker who knows which lenders are more open to past gambling

You can substantially improve your chances of getting a mortgage approved by removing these red flags from your financial history.

Image Source: Money Saving Guru

Variable income from commissions and bonuses needs extra care during mortgage applications. Lenders inspect these earnings differently from regular salary. The right presentation is vital for approval.

What is variable income

Variable income includes any earnings beyond your base salary – commissions, bonuses, overtime, and tips. These income sources aren’t guaranteed for mortgage purposes and change based on performance or employer discretion. Many roles from sales positions to management have most important variable components that are a big deal as it means that they exceed base salary.

Lenders must verify “the history of receipt, the frequency of payments, and how the amount of income received has changed in the last two years”. This extended verification explains why variable income needs more documentation than standard salaries.

Why consistency is key

Stability in your variable income matters most to lenders. They are “more likely to accept your commission as income if it is shown to be stable”. Monthly fluctuations should stay under 20%.

Different lenders have different assessment periods:

- Some average the most recent 3-6 months

- Others need 12-24 months of history

- Many want the variable income on your latest payslip

Without doubt, uneven earnings worry lenders about your ability to keep up with mortgage payments if you miss work targets. Lenders look at both “current overtime earnings for the period and the year-to-date overtime earnings” to check consistency.

How to present your earnings

Here’s how you can maximise your variable income’s acceptance:

Start by collecting detailed documentation. You’ll need 3-6 months of payslips at minimum, possibly up to two years for annual bonuses. Lenders “require a minimum 3 months of employment with your current employer” before they’ll think over commission income.

On top of that, it helps to get an employer letter that confirms your bonus or commission structure. This formal confirmation makes your application stronger. It shows your variable income comes from an ongoing arrangement, not just one-time payments.

Each lender has different rules, but timing can work in your favour. Your application might do better if you submit it when the averaging period captures your highest earnings, especially if your income changes with seasons.

Image Source: Boon Brokers

Success in mortgage applications depends on qualified professionals who provide vital support. A team of experts can make the mortgage process easier and boost your chances of approval.

What roles they play

Mortgage brokers connect you with lenders that match your financial profile. They look through available mortgages, handle your applications, and talk to lenders on your behalf. We relied on brokers to save time by finding lenders likely to approve our application.

Solicitors or conveyancers take care of transferring property ownership. They run property searches, handle contract exchanges, move funds around, and register properties with the Land Registry. These experts make sure everything meets legal requirements before completion.

Estate agents sell and market properties. They show you homes and give you property details. These agents work between solicitors, buyers and sellers to help move the purchase forward.

Why a good team matters

The right professionals can speed up your property purchase. Mortgage brokers know the market inside out and find deals that fit your needs. Good solicitors spot legal problems early and help you avoid getting pricey delays.

Your solicitor’s relationship with the estate agent needs good communication. Professionals who work together well can solve problems quickly and keep things moving.

How to choose the right professionals

Mortgage brokers should:

- Be “whole-of-market” with access to all mortgages

- Tell you about mortgages that come directly from lenders

- Have clear fees and service packages

- Be qualified and listed on the Financial Services Register

Look for solicitors who know the local property market. Sign up with multiple estate agents to see more properties.

Ask potential professionals if they’re available at the time you need them – like evenings and weekends when questions come up.

Comparison Table

Conclusion

Getting your finances ready for a mortgage application takes careful planning and discipline. This piece outlines twelve key elements that can substantially boost your approval chances in today’s competitive market. A clean credit history shows lenders your financial responsibility. You should avoid payday loans and manage credit cards wisely.

Setting up regular direct debits helps your case. You need to reduce existing debt and keep your account in the black. These steps show lenders you can handle mortgage payments well. The paperwork might look overwhelming at first, but proper preparation speeds up your application and prevents delays.

Self-employed applicants must maximise their verifiable income through proper accounting and documentation. Your bank statements should be free from gambling transactions and unauthorised overdrafts to present your finances well. Lenders look closely at your bank statements to find consistent behaviour patterns rather than short-term improvements.

Working with trusted professionals like brokers, solicitors, and estate agents is a great way to get guidance through this complex process. Their expertise helps you avoid pitfalls and secure better terms.

Frequently Asked Questions

How many payslips do I need to apply for a mortgage?

Most lenders require your three most recent consecutive monthly payslips when applying for a mortgage. If you receive income weekly, you may need to provide up to twelve weeks of payslips. Some lenders also request your most recent P60 to verify your annual earnings. If you have variable income from overtime, bonuses, or commission, lenders may ask for additional payslips covering six to twelve months to establish an average figure.

Do I need a perfect credit score to get a mortgage?

No, you do not need a perfect credit score to be approved for a mortgage. While a higher score will generally unlock better interest rates and more lender options, many lenders accept applicants with less than perfect credit histories. What matters most is demonstrating responsible financial behaviour, such as making payments on time, keeping credit utilisation low, and being registered on the electoral roll at your current address.

What documents do self-employed applicants need for a mortgage?

Self-employed mortgage applicants typically need to provide at least two years of accounts prepared by a qualified accountant, or two years of SA302 tax calculations and corresponding tax year overviews from HMRC. Limited company directors usually need to show their salary and dividend income alongside company accounts. Some specialist lenders may accept just one year of trading history, though these are less common and may come with higher interest rates.

How many months of bank statements do mortgage lenders need?

Most mortgage lenders require three months of consecutive bank statements for all accounts you hold, including current accounts, savings accounts, and any accounts where your salary is paid. Lenders review these statements to assess your spending habits, verify your income, check for regular financial commitments, and identify any concerning transactions such as gambling activity or unexplained large deposits.

Can I apply for a mortgage before finding a property?

Yes, you can and should obtain an Agreement in Principle before you start actively searching for a property. An AIP confirms how much a lender is willing to offer you in principle and is usually valid for 60 to 90 days. Having an AIP in place strengthens your position as a buyer, particularly in Scotland where solicitors often expect proof of funding before submitting formal offers on behalf of their clients.

The path to mortgage approval can be challenging. However, these twelve key elements will make you an attractive candidate to lenders when you prepare carefully. Start using these strategies six months before you apply. This approach will give you confidence instead of worry when you submit your mortgage application.

FAQs

Q1. How long before applying for a mortgage should I start preparing my finances? It’s advisable to start preparing your finances at least 6 months before applying for a mortgage. This gives you enough time to improve your credit score, reduce existing debts, establish consistent financial habits, and gather all necessary documentation.

Q2. Can occasional gambling transactions affect my mortgage application? Yes, even occasional gambling can negatively impact your mortgage application. Lenders view gambling transactions as a red flag, regardless of the amount. It’s best to avoid all betting activities for at least 3-6 months before applying for a mortgage.

Q3. How do lenders view variable income like commissions and bonuses? Lenders typically require evidence of consistent variable income over an extended period, usually 3-24 months. They look for stability in these earnings, with fluctuations ideally less than 20% per month. Providing employer confirmation of your commission or bonus structure can strengthen your application.

Q4. What’s the importance of setting up direct debits for bills when applying for a mortgage? Setting up direct debits for regular bills demonstrates financial responsibility and organisation to lenders. It shows you can consistently meet payment obligations, which is crucial when assessing your ability to handle mortgage repayments. Aim to have direct debits in place for at least 6 months before applying.

Q5. How can working with a mortgage broker improve my chances of approval? A mortgage broker can significantly improve your chances of approval by matching you with lenders most likely to accept your application based on your financial situation. They have expert knowledge of the market, can recommend suitable deals, and handle communications with lenders, saving you time and potentially securing better terms.