★ Key Takeaways

- Fixed rates lock in your payments for 2-5 years, offering predictability and protection from rate rises

- Tracker mortgages follow the Bank of England base rate (currently 3.75%), so your payments move with interest rate changes

- Current best rates: 2-year fixed from 3.47%, 5-year fixed from 3.74%, 2-year tracker from 4.42%

- Fixed mortgages typically have early repayment charges (1-5%), while trackers often offer more flexibility

- When your deal ends, you move to your lender's SVR (typically 6-8%) – always remortgage before this happens

Introduction

Choosing between a fixed or variable rate mortgage is one of the most important decisions you'll make when buying a home or remortgaging. It affects how much you pay each month, your financial stability, and whether you can benefit from falling interest rates.

With the Bank of England base rate currently at 3.75% (as of December 2025) and expectations it could fall to around 3.5% by mid-2026, the decision has become even more nuanced. In this guide, I'll explain exactly how each type works, compare current rates, and help you decide which is right for your circumstances.

What Is a Fixed Rate Mortgage?

A fixed rate mortgage locks in your interest rate for a set period – typically 2, 3, 5, or even 10 years. During this time, your monthly payments stay exactly the same regardless of what happens to interest rates in the wider economy.

This is the most popular choice for UK borrowers, particularly first-time buyers who value budget certainty. If the Bank of England raises rates, you're protected. However, if rates fall significantly, you won't automatically benefit.

Fixed Rate Pros and Cons

| Pros | Cons |

|---|---|

| Predictable monthly payments for budgeting | You miss out on savings if rates fall |

| Protection from interest rate rises | Early repayment charges (typically 1-5%) |

| Peace of mind and financial stability | Often higher arrangement fees |

| Easy to plan for the fixed period | Less flexibility if circumstances change |

What Is a Tracker Mortgage?

A tracker mortgage has an interest rate that moves directly with the Bank of England base rate. For example, a tracker at "base rate + 0.5%" would currently charge 4.25% (3.75% + 0.5%). When the base rate changes, your rate changes too – usually within a month.

Trackers are transparent and can offer excellent value when rates are falling or stable. With the base rate expected to decline to around 3.5% by mid-2026, tracker borrowers could see their payments reduce automatically.

Tracker Rate Pros and Cons

| Pros | Cons |

|---|---|

| Often lower starting rates than fixed | Payments go up if base rate rises |

| Automatically benefit from rate cuts | Unpredictable monthly payments |

| More flexibility – often no or low ERCs | Harder to budget long-term |

| Transparent – directly linked to base rate | Financial uncertainty in volatile markets |

Not Sure Which Rate Type Is Right for You?

Get personalised advice from Marc on the best mortgage deal for your situation.

Book Your Free ConsultationWhat Is the Standard Variable Rate (SVR)?

The Standard Variable Rate is your lender's default rate – what you move onto when your fixed or tracker deal ends. Unlike trackers, SVRs don't have to follow the base rate. Lenders can set them however they wish, and they're typically much higher than deal rates – usually between 6% and 8%.

Being on SVR is almost never a good idea. If your deal is ending, you should start looking at remortgaging options 3-6 months in advance to avoid this expensive default rate. Learn more about what happens when your fixed rate mortgage ends and how to prepare.

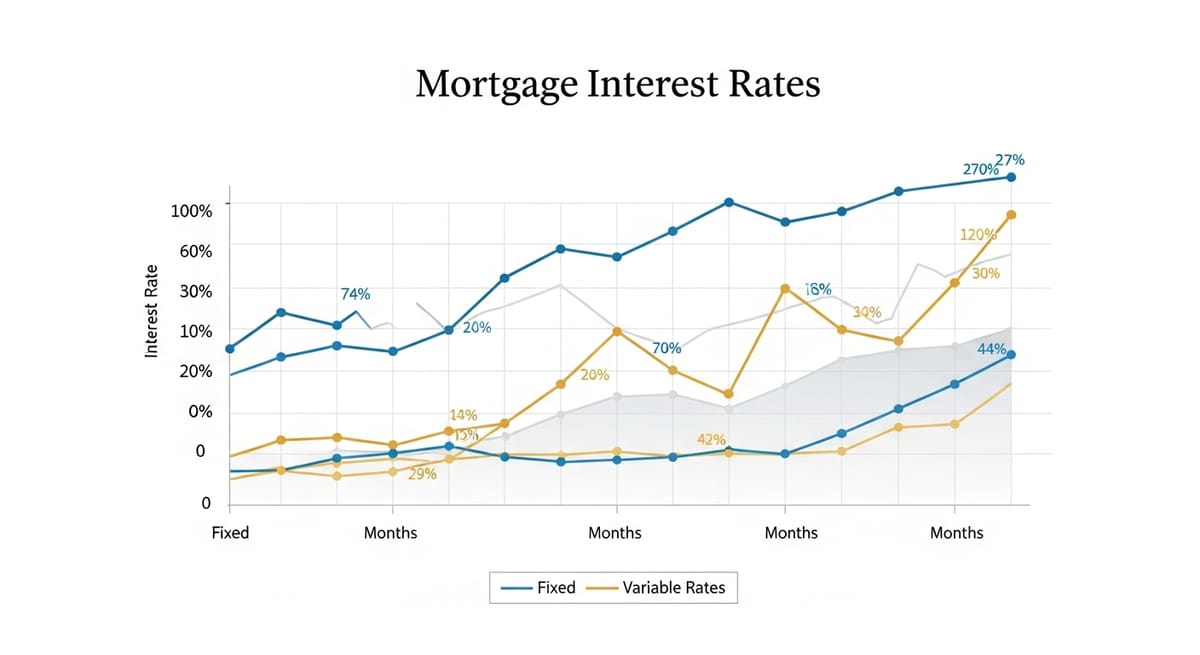

Current Mortgage Rates Comparison (February 2026)

Here's how the different mortgage types compare right now. Note that the best rates typically require a larger deposit (often 40% or more) and a strong credit history.

| Mortgage Type | Average Rate | Best Available | Notes |

|---|---|---|---|

| 2-Year Fixed | 4.81% | 3.47% | Short-term certainty, remortgage sooner |

| 5-Year Fixed | 4.89% | 3.74% | Longer protection, peace of mind |

| 2-Year Tracker | 4.42% | Below 4% | Benefits from rate cuts |

| SVR | 6-8% | N/A | Avoid – always remortgage before this |

Rates shown are indicative based on market data as of February 2026. Actual rates depend on your deposit size, credit history, and the specific lender. Contact me for the latest available rates.

Which Should You Choose? A Decision Framework

The right choice depends on your personal circumstances, risk tolerance, and financial situation. Here's a framework to help you decide:

Choose a Fixed Rate If:

- You want predictable monthly payments for budgeting

- You'd struggle to afford higher payments if rates rose

- You're a first-time buyer wanting stability

- You don't plan to move or overpay significantly during the term

Choose a Tracker If:

- You believe interest rates will fall or stay stable

- You can afford payment increases if rates rise

- You want flexibility to remortgage without penalty

- You may sell or move within the next few years

Understanding how much you can borrow and your comfort with payment fluctuations are key to making the right choice.

Frequently Asked Questions

What happens when my fixed rate mortgage ends?

When your fixed term ends, you'll automatically move onto your lender's Standard Variable Rate (SVR), which is typically 6-8% – significantly higher than deal rates. To avoid this, start exploring remortgage options 3-6 months before your deal ends. Many lenders let you lock in a new rate up to 6 months in advance.

Can I switch from fixed to tracker (or vice versa) mid-term?

You can remortgage at any time, but if you're on a fixed rate, you'll likely face early repayment charges (ERCs) of 1-5% of your loan balance. With trackers, ERCs are often lower or non-existent, giving you more flexibility. Always calculate whether the savings outweigh the penalty before switching.

Is a 2-year or 5-year fixed better right now?

With the base rate at 3.75% and expected to fall, a 2-year fix lets you remortgage sooner to potentially benefit from lower rates. Our guide on when to remortgage can help you time it right. However, if rates don't fall as expected (or rise), a 5-year fix gives you longer protection. Your choice should depend on your risk tolerance and how long you plan to stay in the property.

Are tracker mortgages risky?

Trackers carry more risk than fixed rates because your payments can increase if the base rate rises. However, they also offer potential rewards – if rates fall, you automatically pay less. The key is ensuring you can afford higher payments if rates do increase. Stress-testing your budget at a higher rate (say, base rate + 2%) is a sensible approach.

Get Expert Mortgage Rate Advice

Choosing between fixed and variable rates isn't one-size-fits-all. The right choice depends on your income stability, risk appetite, future plans, and the current market environment. With rates constantly changing, having access to the whole market and expert guidance is invaluable.

At McGhie Mortgages, I help buyers and homeowners across Edinburgh, the Lothians, and all of Scotland navigate these decisions. Whether you're a first-time buyer choosing your first mortgage or looking to remortgage from an expiring deal, I'll search the whole market to find the best rate for your circumstances.

Ready to find the right mortgage rate for you? Book a free, no-obligation consultation and let's discuss your options.